The fun and troubles with crowdfunding (it’s amazing CU survived ;-).

Bart

________________________________________

The Author is Daniel Brown

[Authors notes] 1) Thank you readers and media organisations alike for spreading my works with this article. It has been featured on a number of 3DP news websites including Fabbaloo,Inside3DP, Printing 3D Today and 3D Printing Industry.2) For reference, my article is not referring to specific companies, it is referring to the industry as a whole. This whole thing started around July 2013, when I started watching these companies. My examples are all based on my experiences and using $AUD.

3) This article is referring to traditional-design cartesian 3D printers, sold as assembled. The costs would change depending on the style of printer, size, print bed and also the country manufactured in.

[/AN]

1st August, 2014

Introduction:

I am writing this article recently as I have been following the development of many Kickstarter 3D printers for over a year and the market has reached a point this month where I feel like legitimate companies are being damaged by cash-grab start-ups. Businesses with fraudulent financing models are dragging this entire industry down but it seems too many people give these companies the benefit of the doubt for being young and naive. I believe a harsher reality check is needed, the optimistic 3D printing public needs to be warned about these companies which will fail and the companies themselves need to be warned of their own shortcomings before bankrupting themselves. It is a lose-lose situation for everyone, even people who don’t back any 3D printers on Kickstarter.

I use the term Kickstarter throughout this article but Indiegogo can be used interchangeably.

This article is a very general overview that doesn’t apply to all companies or one in particular, but the chain of events I will describe happens all too often and ends up the exact same way. Some companies might mix things up, do some things right and some wrong but ultimately they all make 2 fatal flaws. First though, I will talk about minimum required goals to be successful. There is a massive amount of money that does not add up in almost every single Kickstarter printer project. I will then look at those companies that earn too much money and sink themselves. The first section about building a printer is critical to understanding the second section about selling it at a proper price.

How cheaply can a 3D printer be built?

I have been working with a colleague of mine for over 6 months now as we experimented with all sorts of printer designs and he builds his own with over 3 years of experience, running his own small business as a second job building his own customised open-source printers. We even looked at printing all sorts of exotic materials however this article is focused on our efforts to make a normal, plastic open-source FDM machine. The strategy was to just make a business selling printers, we didnt want to go overboard however if the price was right, we would delve into the world of mass manufacture and see just what it took if we wanted to make it big.

Here I learned the true costs of building printers as I worked with a venture capitalist wanting to pump money into this business pending my feasibility study. We found out that the cheapest possible cost for a printer 1 off was around $300 or so with a large chunk of this cost being the rigid frame. The costs of this frame could be cut down drastically with larger orders but the other components required gigantic orders to get any reasonable discount. We found that even assuming 10 printers built per week for 6 months, we couldn’t get the raw materials cost below $180. This cost is otherwise known as the ‘vitamins’ of a 3D printer being everything except the frame whether it is a metal box (replicator 2), solid sheet (prusa) or exoskeleton (mendel). The expensive line items though, were mostly non-negotiable. We could source motors cheaply if we bought a lot but the electronics board, hot ends and power supply have few options to reduce costs by much. This is a critical factor. This cost of $180 however, was assuming we 3D printed lots of components when going for the budget ‘exoskeleton’ model.

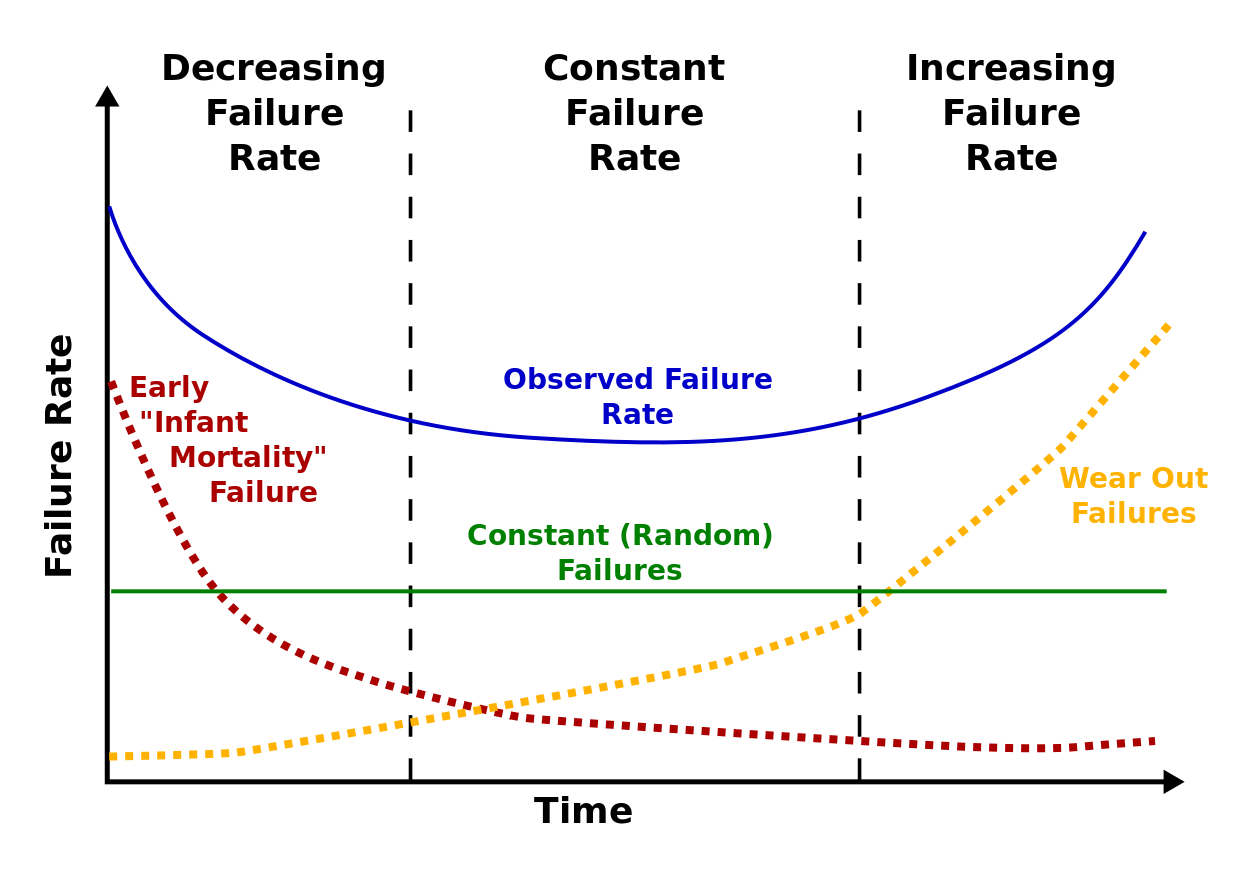

I then had detailed talks with an injection molding consultant. I was quoted around 50k for all the molding all up and only a handful of dollars for parts after that. A point to note here was a 2 month lead time, 1 to even start the job and 1 to complete it. This was quite standard and assuming parts were molded in Hong Kong so they were already quite cheap. My consultant here told me to expect 10% of any sales cost to be lost on replacements but since this was a brand new project, expect closer to 25%. This is related to the bathtub curve Weibull function in reliability engineering, a widely used function.

Feasibility Study

It was time to conduct a feasibility study on the businesses of making and selling 3D printers. Our expenditures were injection molds, printer parts, salaries and warranty backup funds. Our income would be Kickstarter orders and outside VC funding. From here on in, the following scenario describes the minimum viable funding for a printer to be successful. Our personal example of $100k VC funding will come into play later.Whether the printer has a selling price of $299 or $9,999 the equation remains the same, this is the minimum.

Injection molds: A 1-off cost of around $50k. There is no room for error here, a heavy lead time meant this must be done right the first time.

Printer parts: $180 per printer, assuming under 5000 printers were sold within 1 year.

Salaries: We needed 4 people working full-time to support this, 1 manager, 1 engineer and 2 people building the machines. If this project was to succeed, it needed a full-time effort. This would be at $50k each for a year, factoring in we are all professionals, not kids.

Warranty funds. 25% of printer costs, therefore $45. This is directly added onto the printer part cost and includes all shipping and extra costs involved in tech support and updating parts.

The feasibility study comes down to the following equation. This equation is simplified for now, it will be expanded later on.

Total cash > Total expenditure

(Printers sold*selling price) + VC funds > Injection molds + salaries + (Printer cost*printers sold)

Which will now be shortened to

P*S + V > I + Salaries + (C*P)

Printers sold at selling price = Kickstarter revenue (P*S = $K), and Kickstarter takes 4%, therefore

0.96*$K + $V > $50k + Salaries + ($225*P)

We will give these companies 6 months to fulfil their orders which is a usual timeframe, therefore the ‘salaries’ cost is halved

0.96*$K + $V > $50k + $100k + ($225*P)

The equation now has 3 variables in Kickstarter goal, selling price and number sold with V and S being set independently. We will deal with these later. The issue that countless Kickstarter printer start-ups run into is that they attempt to solve this equation by setting $K first, then the desired selling price and then alter the rest to fit. This strategy is to set a low enough goal to give them a higher chance of being funded however this strategy sets them up for immediate failure. This is what happens when they do that. A common target selling point is $299. Please recall at this point, my function is to determine minimum viability so the function remains applicable with a higher selling point.

Assuming $0 in outside VC funding (ie; most Kickstarter printers)

0.96*$K = 0.96*P*$299

P*$287 > $150k + (P*$225)

P*$62 > $250k

P>2420

The company must sell more than 2420 printers to satisfy the income>expenditures equation which means they must raise 2420*$299 = $724,000. Yikes.

So what happens when a company of 4 people and a printer that costs $180 worth of parts, raises say… 200k? That seems like a lot of money right?

0.96*$200K + $0 > $50K + Salaries + ($225*($200K/$299)) [note the 0.96 factor is only applied to the money received, not the money raised]

$192K > Salaries + 200K

Salaries < $-8K

The company is insolvent before we ourselves are broke.

But wait… there is still something missing here. The above example was simplified, now it must be adjusted for the real world with taxes, insurance and marketing etc. The equation must now add in these factors:

0.96*$K + $V > $50K + Salaries + Marketing + facility leasing + insurance + taxes + electricity + ($225*P)

Salaries + marketing + facility leasing + insurances + taxes + electricity < -$8k +$V ($V=$0)

Now the equation has become downright impossible, even if they got in $100k worth of VC funding (such as our example)

$92K > salaries + marketing + facility leasing + insurance + taxes + electricity.

For a four person team, it cant be done realistically!

The problem with so many Kickstarter campaigns is their goal is so low, that there is not enough room for salaries while all other expenditures are ignored and especially Kickstarters’ commission. So many campaigns set a goal to cover the molding costs alone, but it is so insignificant in the larger scheme of things!

What is the minimum goal for the cheapest printer?

So how about we try and see what sort of goal is actually needed to not go bankrupt immediately. Lets go ultra-conservative to prove a point. We will assume that salaries + marketing + facility + insurance + taxes + electricity costs will amount to around $150k for the 6 month period, the employees will take a hit on their own salary to offset all those extra costs. But they still want that $299 printer. They are now faced with the following equation

X = the intended price point of the printer

S = salaries and all other manufacturing expenditures

C = cost of printer parts

M = molding costs

0.96 = Kickstarter commission

Y = Required Kickstarter goal

P = Printers sold

0.96*y > S + M + P*C [Y = P*X, P = Y/X]*

0.96*Y > S + M + C*Y/X

0.96*Y(1-C/X) > S+M

0.96*Y > (S+M)/(1-C/X) [1/(1-C/X) = X/(X-C]*

0.96*Y > X*(S+M)/(X-C)

Y = 1.04*X * [(S + M)/(X-C)]

For the case of this theoretical company that has built a dirt-cheap printer costing only $180 of parts, using a fund of $150k to cover 4 people full-time employed and all manufacturing costs (assumed $50K)

*EDIT: It appears that my wording was not clear enough. My salary costs is of course referring to the local assembly costs, this does not apply to printers sold as kits or manufactured in Asia! They have their own set of teething issues though.*

Y = 1.04*X*[150000/(X-$225)]

Therefore this graph determines the required Kickstarter goal for this company to afford their own expenditure, vs the cost of the printer they are selling.

This graph does not lie. Every $ below that line, represents money coming directly out of the fund they use to pay themselves. If they fall below this line, their expenses have exceeded their income, they are insolvent as they can not afford to buy the parts for the printer. Literally the only way to stay afloat is to pay yourself less and less. The company that sells a $299 printer and raises only $250k will have exactly $9,398 to pay 4 people for 6 months and covers marketing, legal, taxes, electricity, tech support… That company has a very short future. And again, this is assuming a perfectly smooth operation with a fully-developed printer and no delays or issues.

These companies can not simply choose to operate at a loss, because that will lead to a fraction of customers receiving their product, and it becoming a paperweight as the company folds shortly after. There is only one way to survive this and that is to set your salaries first, then you set your retail price point, then you set a Kickstarter goal. From here, the selling point can be altered to give more realistic goals.

I will be blunt here. The chances of any company making a low-cost 3D printer, that raises below that viability line surviving, is almost zero. The selling point must be high enough. They can fudge the numbers all they want, it doesn’t matter. Say this company is in bed with a Chinese manufacturing giant and sources all their parts for only $140 (which is outrageous, C = $140*1.25 = $175)? (Blue line in below graph)

How about a company which only consists of two people, and they are content to live on only $20k per year assembling the printers in a garage? (S=40K, Facilities=$0) (Red line in below graph)

But a company of 2 people selling these printers at $299 must produce 1290 printers in 6 months… That’s a bit of a stretch!

What about that company that raised over a million dollars, but had a team of 10 people? (S=500K)

(Yellow line in below graph)

Feel free to add your own numbers into my equation and investigate what is viable and what is not. Always remember, this is the best case scenario, assuming the printer design is finalised and there are no losses with bad supplier parts etc. The above scenarios highlight that even in a perfect world where everything comes together smoothly, people can assemble 10 printers every day and do so for minimum wage, the required goals are still far higher than most Kickstarter projects set and still higher than what they end up getting anyway.

How can a new company survive?

The worst part about all this is that with so many low cost 3D printers on the market, they all eat away at each others chance to succeed. Having 10 printers all get $200k each is a disaster for our industry because each one of these companies will face insolvency. If 3 companies got $660k each, then we would be alright. They would all be self-sufficient and functioning within one year. But alas, we are stuck with dozens of companies that cant survive.

Never forget, this analysis assumed that the printer was fully developed and ready to go right from the start. Injection molds were ready to go the day the campaign finished.

After all of this analysis, we look at the two successful companies to still exist today after success through Kickstarter, Printrbot and Formlabs. What did these companies do differently to the rest? They target massively different markets, the price difference is huge, one is a kit and one is built. No, it is not a case of comparing what they did different to the rest, it is what did they do the same? The answer is simply sufficient a profit margin.

These two companies set themselves apart from the rest by building a sufficiently large profit margin into their machines. This margin allowed the company to not only survive the Kickstarter death trap, it allowed the companies to grow, hire more people and most importantly, remain relevant after the campaign. Because a company that plans to be in business after Kickstarter, is the only company that will acknowledge why you need a high profit margin once the rush stops.

But of course, how many low cost Kickstarter machines follow in their footsteps? Why are they all racing to the bottom, when success is only found at the top? I think I have explained my reasoning enough at this stage, that low cost 3D printers set themselves up for failure.

There’s something else though, another way out from the pit of bankruptcy that these Kickstarter companies have devised… This is what has me so enraged about the 3D printing industry at the moment. What about the campaigns that become very successful? The ones that promise a lot, raise over 200k despite offering a low-cost printer? Whilst bankruptcy can be excused as companies being naive and running out of money, the companies that participate in the schemes I am about to describe are outright fraudulent, taking peoples money with no chance of delivering a product.

As I explained earlier, companies can succeed with a low cost 3D printer if they raise enough money, and good on them. They have the platform to succeed at the expense of other companies, now is their chance to make a real dent in the market. There are companies making printers which are high priced. Their prices will ensure they remain in business at a rate proportional to how many they sell but at the least, they wont bankrupt themselves immediately.

The demon though, of 3D printing on Kickstarter, is companies that have not finalised their design, set a low goal below the viability line (cost of the printer is irrelevant for this) and/or offer stretch goals. In fact, having stretch goals even available is indicative of the design not being finalised. The red flags must be raised, because this is what happens.

Red flags ahead

The following is a general order of events that a number of 3D printing start-ups have followed. Some companies may have done certain steps differently, however the common factor of deceit runs rampant through every step of the way. Welcome to Kickstarter hell.

A company lists on Kickstarter with a brand new 3D printer. At this stage, they do not have a fully-functional, design-will-not-be-altered prototype. This is a fatal mistake, but not the only one. They may or may not be open to the public about how complete their prototype is, but it doesn’t matter later on.

The company sets a strangely low goal purely to cover molds (typically around $50-$100k depending if the printer uses things like an enclosure which is very expensive to mold) and leave no room for after market support. Their salaries are built into the profit of the printer, but with a goal of only 100k, the molding cost and taxes will eat into all of their salaries. These companies have set their goal far below the viability line, they do this because they just want to be ‘funded’. By accepting peoples money early on and reaching an insufficient goal, the company has set themselves up for failure. They must exceed the viability line. But this isn’t fraudulent, yet.

The company aims to re-coup losses with a higher price after Kickstarter to offset their low initial selling point. This is the second fatal flaw. Combined with the non-ready printer, companies adopting this strategy will likely be forced to enter a Ponzi or pyramid scheme if they are to survive.

These companies have not set any money aside for the development of the printer, their Kickstarter goals prove that. Their solution? Stretch goals. By raising exceedingly high amounts of money (over 250k up to the millions) the companies plan to use this extra profit to fund the future development of the printer and give outrageous rewards for more people backing the printer. Stretch goals however are a fatal flaw because these companies offer extra features for the printer, at no extra cost.

Stretch goals are a quadruple-blow on their bottom line. Kickstarter and taxes take more and more money yet the profit on each printer is the same. The additions themselves cost more money, reducing the profit margin further on each printer and now the printer will take longer to make, using even more funds! If that wasn’t enough, the product will now face extra delays which will damage it later, I will explain then.

This is dangerously close to a scheme. Companies attract more investors, claiming that the more people who invest, the better their rewards will be. Whilst that can technically be true, it relies on an extraordinarily large amount of printers sold. In my above example of the $299 printer, if an extra $30 worth of value is added to each printer, the companies minimum required Kickstarter becomes a whopping 1.06 million! Now to ship a staggering 3,500 printers in the space of six months, lets say our salaries and facilities costs have blown up to $700,000 to pay a team of 15 people (halved for 6 months, add $50k manufacturing costs), the equation has changed again now Y = 1.04*$299*[($425000)/($299-$255)]… 3 million dollars.

This is what happens when a company adds a mere $30 extra of parts per printer, for free. The required Kickstarter funding has blown up from $630,000 to $3 million. Stretch goals on low cost printers are a death sentence. Stretch goals require gigantic amounts of printers to be built which requires a much larger team of people to assemble, none of these costs were considered in their original goal of 100k.

To save the readers another wall of maths and examples, stretch goals actually become viable on printers with a high profit margin built into them. I have calculated that the cheap printer example selling for around $549 will be able to introduce a stretch goal worth $30 at $1M and stay above the viability line. The downside is, setting a higher price point to cover them in the event of hitting a stretch goal will seriously hurt their ability to sell if they don’t reach it! A company that adds say, dual extruders at $1 million must increase the price of every single printer by around $100, even if they get $999,999. Why would customers pay $100 for an upgrade they may never get? Not only that, they must pay for every upgrade on every stretch goal! If the company doesn’t do this, they will bankrupt themselves the instant the first stretch goal is hit.

I do not believe this fact is ever considered when people think of stretch goals. If a company ships a product that cost them $200 to build but sells for $400 with stretch goals worth $10, $30 and $50 as they go along, the company cant change the price of the backers’ orders after the campaign is done! They have locked themselves in at a gigantic loss since their selling point must be the same if they get $100k or $1M, they cant predict this.

You can’t recoup losses when you have no backing

The low-cost 3D printing companies of have a strategy though to ignore these numbers whether they have stretch goals or not. This strategy is fraud as far as I am concerned. These companies all plan to secure more and more orders after Kickstarter at a higher profit margin. These profits will offset the gigantic losses incurred early on. But they cant make a loss before the product ships as these start-ups aren’t backed by larger companies, how can they possibly recoup it if they go bankrupt before given a chance? Its simple; never build the backers’ printers and enter a scheme.

Companies will use their gigantic wad of cash to continue to develop the printer and engage in crazy marketing schemes to get more customers after the Kickstarter orders are done (which never happens). By now they have realised they are in an impossible situation. Their total cash now is below the costs to build all of the backers’ printers. They have 3 options, they admit they messed up and refund all backers whatever money they have left, it might be a small fraction of what they originally paid. They could cut functionality down drastically which means not only cutting all stretch goals, the extra money Kickstarter has taken as a result of their higher earnings means cutting original functionality too as now they must bring the functionality of the printer down below what was originally planned. Unfortunately this can also result in the company folding since all of their profit was lost in the preceding months and they will now be faced with a total redesign, verification and validation and another 2 months on injection molds. That time eats more into the money raised and there is even less now to fund the building of each printer.

These two methods are feasible escape routes and can work if managed correctly, although neither of them are good for the backers. Its a waste of money and a waste of time, they could have bought a more capable printer months earlier.

But that’s not what these companies do is it… No, instead they enter a scheme.

They can not possibly build the backers printers as the losses are too gigantic, so they will spend their efforts working on a retail version of their product. These companies have a strategy to regain profits on these new printers and use this money to fund the development of existing orders. Companies will perfect a few versions of their prototype and give copies to tech bloggers, demonstrate them at trade shows or visit schools with them. They do this to give the illusion of moving production along when in reality, they still can not afford to build the Kickstarter printers and every day that passes puts them more in debt.

Here comes the famous Kickstarter delays. The product is behind schedule because the product was not finished when the campaign started, and now manufacturing simply can not happen without a lot of new orders. The companies will lie through their teeth to investors and gullible markets to secure new orders. A common target is schools. The transfer to a scheme is complete.

The company now alters their product to a new point of difference. Since they cant advertise on cost any more, they now focus their advertising on being easy to use. It is the easiest way to ring in buyers, they have no other option.

By this time, the company has waited far too long and the market has shifted to the next exciting thing. Raising their prices has now made them irrelevant in the market and now the Kickstarter backers demand their refunds. The company still has a lot of money left but they have no intention of even buying parts for their backers’ printers. They will use this money to stay afloat for as long as possible, never delivering anything on the hope of fixing their mess by perfecting an overpriced, market-ready printer which will never sell.

From this point on, the only thing that can happen is they do not get enough extra orders and eventually run out of money, never fulfilling their Kickstarter orders or they do get cash from investors but it will only ever be enough to fund the development of new, higher priced printers since the longer the scheme goes on, the more in debt they become. The stretch goals have caused this. With an ever-increasing priced, outdated printer and negative social media crushing the company, they are finished.

There is still room for some optimism

There is only one way for companies to avoid this spiral of death which is to perfect your prototype and sell it at your desired selling price. Stretch goals without extra funding taken from each backer to cover the additions cuts right into profit margins and the higher the goal, the more Kickstarter takes. They are viable but require a massive profit margin already built into the printer. Loss-leading is never viable strategy in a market which moves too fast and you can’t loss lead on your one and only product.

The only way loss-leading can work is with huge sums of outside investment, these sums must be in the millions and even then, stretch goals must not be included. The 3D printing market moves too fast though.

I see five types of companies in the Kickstarter 3DP market.

There are the companies which want to make it big. These companies are smart and they price themselves at a high enough point to allow them to grow and expand once the Kickstarter rush is over. They are a dying breed, extremely rare.

There are the companies that have basically already made their product and are using Kickstarter as a marketing platform. They might have some larger corporation backing them, they are quite safe. They can afford to set stretch goals since they have a lot of backing behind them. They will usually get their modest goal.

There is the small company that only wants to sell their printer and aren’t overly ambitious. They set a price point which basically keeps the company small. They don’t mess around with stretch goals or loss leading, they’re just normal businesses doing their best to survive. They don’t have a high rate of getting funding.

Then finally we have 2 different type of cash grabbers. The first type want to make something extremely popular but will do this by selling for a very low price point. This is extremely risky and can only pay off if they sell a huge amount of printers, well over a million dollars worth. But they are smart about this and their printer is already developed, there are no stretch goals and they might have VC funding. They have a high rate of getting funded.

The second type of cash grabber is the company that promises the moon and have a strategy involving ‘make as much money as possible, we will finish the printer later’. These companies are the scourge of the industry. You can spot these from a mile away. Stretch goals, short delivery time frames, a lack of information about the actual printer. Everything about them is a cash grab and it is not remotely possible to deliver the backers’ printers. Much to my disappointment, they have a near 100% funding rate and not only that, they usually get way above their goal.

Conclusion:

My analysis made a lot of assumptions but I explained them all and they remain fair. Changing values for salaries, manufacturing and warranty costs will vary the results but I took conservative estimates. Of course, my analysis is entirely in my own opinion and I accept my bias and pessimism however I would not have written this much and spied on so many Kickstarter projects for so long if I wasn’t genuinely worried about the lying going on there.

I believe that almost all low-cost 3D printer makers out there on Kickstarter innocently make mistakes by rather severely underestimating the costs in scaling up production and the costs in supporting a 3D printer with full-time tech support which is critical as the market targets new users. These mistakes however, are not excusable by the companies that plan to make it big in the 3D printing world that offer stretch goals and even allow themselves to sell more than a couple hundred printers. These companies are more likely to make a lot of money and they should know better. Their actions regularly lose hundreds of thousands and in some cases, millions of dollars from people wanting to get into 3D printing.

It upsets me that some of the most enthusiastic and excited people out there who want a 3D printer, are the ones who lose all the money. They don’t have the time or knowledge to know what is viable and what isn’t, they get caught up in the hype of a new exciting product.

The companies that pass the point of no return, knowing full well they can not deliver a product and instead of giving partial refunds, they continue to lose money pursuing a higher RRP printer however, are the scourge of the industry. Their blindness to reality bankrupts themselves and leaves thousands of disappointed customers, tainting the industry.